THE UK GENERAL ELECTION

Readers will be aware that the 8 June UK General Election concluded with an upheaval of the previous government majority and a weakening of Prime Minister Teresa May’s hand.

They may not be fully aware of a huge avalanche of landlord legislation facing some investors that is supported by both major parties (with just minor variations) so likely to proceed whatever the future political composition.

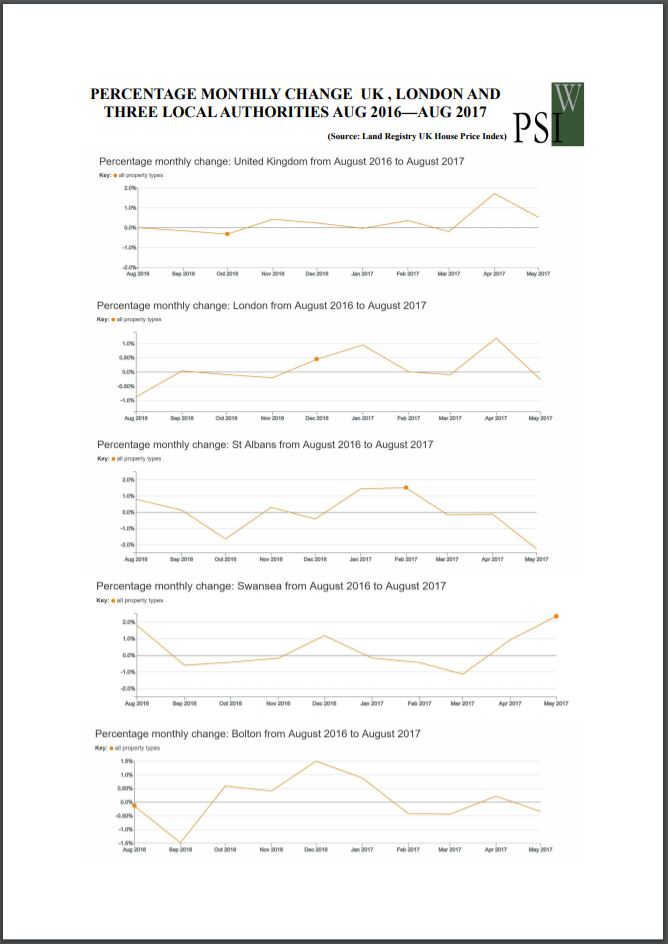

It is secondary that the UK private sector property market typically chases hotspots and I am pleased to have been able to report Swansea in particular in Wales looking bright towards about 2020 under the substantial growth and investment I have documented elsewhere. Where, by comparison, London appears at present, overheated.

Do you rent out property?

Because immediate and prospective housing legislation is driving the UK private rented sector (PRS) towards a crisis of restructuring! This is no-less than a selective, legislative onslaught against the small landlord:

1)In the Middle Ages, Middle-Eastern Governments would levy higher tax upon non-Muslim individuals that worked as a mechanism for converting them. Today’s UK private landlord sole traders is set to suffer tax discrimination under new rules for property letting differentiating this from other classes of business!

1a) Selective, 3% additional buy-to-let stamp duty (technically levied on “additional residential propertyâ€) has already been introduced.

1b) 2017 sees the first year of a 4-year rolling taxation increase differentiating sole trader landlords in the following ways:

Step 1: interest relief on buy-to-let borrowing is removed from the gross tax calculation, henceforth to be calculated net.

The effect of this: higher visible incomes without a rise in actual income may affect the landlord’s broader financial considerations. Further, some sole trader landlords will be transferred to the higher income tax bracket, who weren’t before.

Step 2: no more than the the standard rate of tax is to be able to be deducted under the new, “Section 24” rules.Â

The effect of this: Some landlords will suffer an actual loss of income amounting to – at present – 20%.

Link: https://www.gov.uk/government/news/changes-to-tax-relief-for-residential-landlords

2)Â Energy-saving measures to be enforced:

From April 2018, where the property has an energy performance (EPC) rating of F or G with a few exceptions, new or renewed tenancies are to be prohibited! I gather the Labour party has wanted to raise the bar to energy rating “Câ€. Many landlords with older properties shall be reliant upon claiming exemption.

Link: http://www.arla.co.uk/news/february-2017/government-guidance-on-complying-with-2018-energy-regulations.aspx

Further:

3) Letting agent fees which have been historically shared between landlords and tenants can no longer be levied upon tenants in Scotland, with the remainder of the UK looking likely to follow.

4) Landlord registration and licensing has been introduced in Wales and some areas of London. Whilst not itself harmful since licensing raises professionalism, this may roll out into nationwide training, or alternatively compulsory deregation.

Behind these events great national economic uncertainty looks certain for the UK. A quantity of displaced tenants and disenfranchised landlords may add to the national distress.

But homes will always be called for!

A rise in tenant numbers by 50% is already predicted.

This is all either frightening or exciting news!

I have just returned from a three-day intensive, refreshing my training in Rent-to-Buy. I am a student of additional creative and disruptive strategies. There may be other ways of doing things.

If you are a landlord considering restructuring who has a a flexible approach, please get in touch with me for us to explore together over a coffee (or a telephone conversation) whether I may be able to help you to move forwards.

Michael